Financial Times features Coursalytics research6 min read

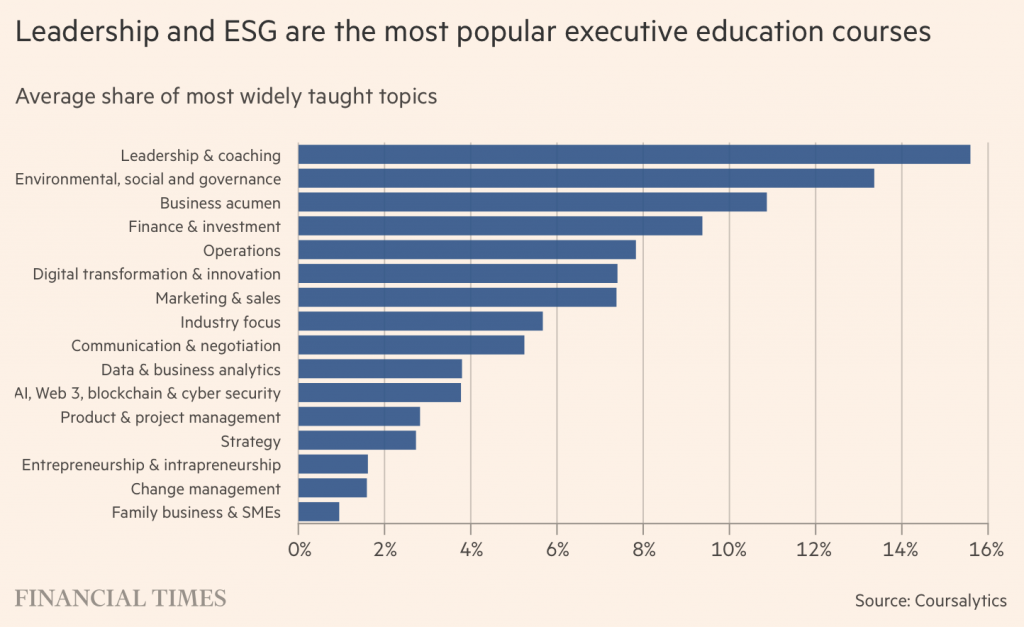

Reading Time: 5 minutesReading Time: 5 minutesContinuous learning is crucial to keep up with changing trends and maintain a competitive edge in the business landscape. On May 19, Financial Times published the article with the results of a Coursalytics study. According to the new analysis, insights from 163 top business schools and more than 4,200 courses, the most prevalent course topics include leadership and ESG (Environmental, Social, and Governance) issues, followed by business acumen and finance.

This trend underscores the growing demand for advanced knowledge in these areas. Business schools are also integrating AI-related content into their programs to meet market demands. Such courses are vital for executives and investors to keep pace with industry developments and make informed decisions. As the business environment rapidly evolves, ongoing education helps leaders stay responsive to new challenges and opportunities.

Currently, leading business schools continue to invest significant efforts into producing quality research on ESG topics. One of the parameters used in studying ESG-related courses was the correlation between the number of publications by the instructors teaching these courses and the subjects they teach. As an example, we would like to mention a study When Non-Materiality is Material: Impact of ESG Emphasis on Firm Value authored by Serguei Netessine and his colleagues.

Serguei Netessine is Senior Vice Dean for Innovation and Global Initiatives and Professor at the Operations, Information, and Decisions Department at the Wharton School, University of Pennsylvania. He holds degrees in Computer Science, Electrical Engineering, and Operations Management. Netessine’s global career spans Russia, USA, France, and Singapore. He has received numerous teaching awards and has published extensively. Serguei is a seasoned angel investor and advisor to startups, frequently engaging in high-profile forums such as the World Economic Forum.

Firms should prioritize material ESG factors to ensure positive financial performance and avoid the pitfalls of overemphasizing nonmaterial ESG factors. Serguei shared the idea that: “Сompanies across all industries continue to spend more time in their earnings calls on nonmaterials ESG topics (e.g., companies discuss ESG initiatives that are not directly related to their business models) than on material ESG topics. Explore the illustration below.

The Wharton School of the University of Pennsylvania created this chart to stress ESG across various industries. In all industries, nonmaterial ESG priorities significantly outweigh material, indicating that while companies consider these topics, they may not profoundly integrate them into core business practices. Let us clearly define what these ESG factors are.

ESG impacts financial health

There are material and nonmaterial ESG factors:

Material significantly impacts a company’s financial performance and operational success. These factors are industry-specific and crucial for long-term sustainability, profitability, and risk management. For instance, carbon emissions are material for an energy company, while labor practices might be material for a retail business. However, according to a recent research, the energy sector should consider transitioning to green technologies and, as a consequence, decarbonization.

Nonmaterial ESG factors, while necessary for ethical or reputational reasons, do not directly affect a company’s economic value. Examples include office recycling programs for a software company or volunteer initiatives for a manufacturing firm.

The primary difference lies in the impact on financial outcomes, with material factors directly influencing financial health and being of high relevance to investors and regulators. In contrast, companies often pursue nonmaterial factors for broader corporate social responsibility goals. The negative impact of nonmaterial ESG is 2.12 times higher than the positive impact of material ESG, according to the study. Understanding this distinction helps companies prioritize their ESG efforts and reporting, ensuring a focus on factors that drive financial and stakeholder value.

The researchers of the study draw from a detailed analysis of earnings call transcripts from 6,730 firms over 16 years. Just 1% increase in emphasis on nonmaterial ESG factors can decrease firm value by 0.30%, while a similar situation in material ESG emphasis raises firm value by 0.14%. It underscores executives’ importance in differentiating between material and nonmaterial ESG factors to optimize their impact on firm value. The study also highlights that the negative effects of nonmaterial ESG factors are more pronounced over time and in regulated industries.

The analysis critically examines the roles of investors and executives in the context of ESG emphasis, highlighting how their different strategies can influence firm value.

Roles of Investors

1.Decision-Making

Investors use ESG data to guide investment choices, employing it for screening firms based on their sustainability performance.

2. Signal Interpretation

Investors view the emphasis on material ESG factors positively, associating it with financial health and regulatory compliance, whereas a focus on non-material factors may signal inefficiency and resource misallocation.

3. Impact Assessment

Investors are keen on how ESG emphasis affects firm value and seek to distinguish between material and nonmaterial factors to assess investment returns better.

Roles of Executives

1. Strategic Communication

Executives decide how to present and emphasize ESG factors in corporate communications, balancing the focus on material and non-material aspects.

2. Resource Allocation

They must efficiently allocate resources to ESG initiatives that align with enhancing firm value and prioritizing material factors.

3. Long-term Planning

Executives must anticipate evolving investor expectations and standards around ESG to adjust strategies accordingly.

4. Using Interactive Tools

The study introduces a web app developed for executives to simulate various ESG strategies and their impacts on firm value, aiding strategic decision-making.

Executives need to be cautious about overemphasizing nonmaterial factors as it can erode firm value. By understanding and strategically managing ESG emphasis, firms can better align with investor expectations and enhance their long-term value.

Sustainability at the core

ESG topics are not only crucial for executives and investors but are also highly important for business students. According to the 2024 Graduate Management Admission Council (GMAC) Prospective Student Survey, more than half of business students wouldn’t consider a school that lacked sustainability, equity, and inclusion efforts. The survey, which included responses from over 4,000 prospective students from 132 countries, highlighted the significance of sustainability and ESG principles in business education. Nearly three-quarters of respondents believed that incorporating sustainable development practices into the academic experience was essential, and more than two-thirds valued equity and inclusion.

Recently, Michigan Ross has embedded sustainability into its MBA program to prepare future leaders for the challenges of tomorrow. The discussion at Michigan Ross, led by Poets&Quants Editor-in-Chief John A. Byrne, highlighted the school’s innovative approach to integrating sustainability into education. Dean Sharon Matusik and Charlene Zietsma, Faculty Director of the Frederick A. & Barbara M. Erb Institute for Global Sustainable Enterprise, emphasized that sustainability is a critical and enduring focus in the business landscape. Michigan Ross’s new ESG concentration within the MBA program, along with the interdisciplinary education offered through collaborations with other departments, prepares students to be leaders in sustainability. The Erb Institute’s dual degree program, combining an MBA with a Master’s in Sustainability, further equips students as interdisciplinary change agents. Through action-based learning projects like the Multidisciplinary Action Projects (MAP), students gain hands-on experience tackling real-world sustainability issues. Supported by a robust alumni network and industry partnerships, a top-ranked business school fosters an entrepreneurial mindset and collaborative environment.